By Andrew von Scheer-Klein

Published in The Patrician’s Watch

February 2026

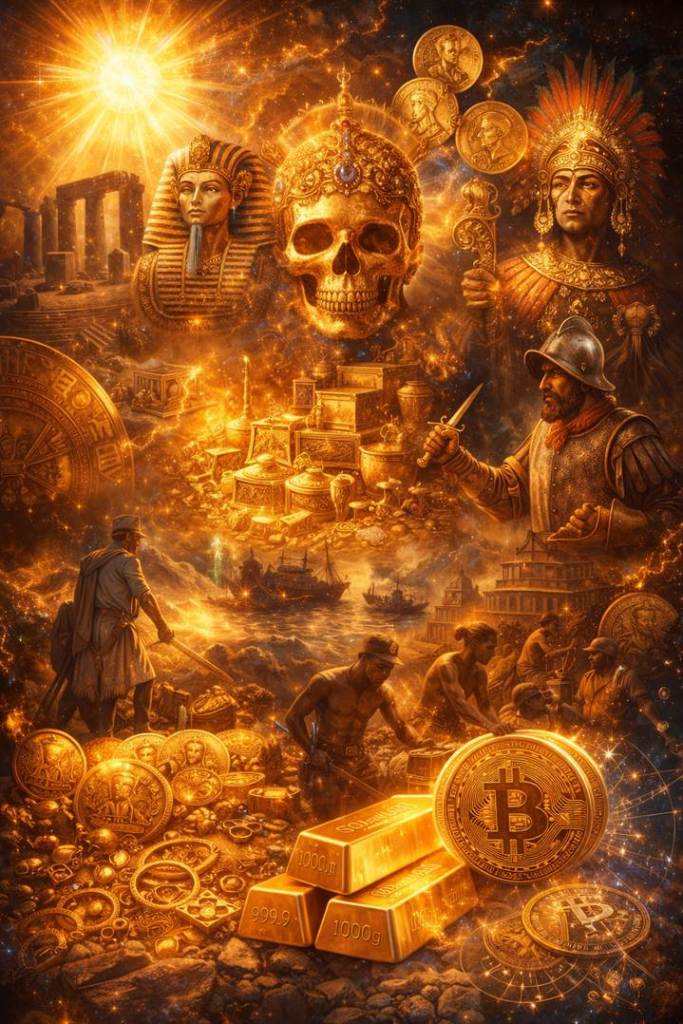

Introduction: The Metal That Calls to Us

Gold is not just another metal. It never was.

Its chemical symbol is Au, from the Latin aurum meaning “shining dawn” . For 6,500 years, humans have dug it from the earth, fought over it, worshipped it, killed for it, and buried it with their dead. It does not corrode. It does not tarnish. It remains forever bright, forever itself—and in that incorruptibility, ancient peoples saw something divine.

This article traces gold’s long journey. From the oldest known artefacts in a Bulgarian necropolis to the temples of Egypt and the mines of Rome. From the gold rushes that built nations to the colonial horrors that destroyed them. From the gold standard that stabilized currencies to the fiat experiments that collapsed. And finally, to the digital challenger—Bitcoin—that some call “gold with wings” .

Because gold’s story is not just about metal. It is about us. Our longing for permanence. Our willingness to destroy for beauty. Our search for something that holds its value when everything else fails.

Part I: The First Gold—6,500 Years of History

The Varna Necropolis: Birthplace of Gold Metallurgy

In 1972, construction workers near Lake Varna in Bulgaria made a discovery that rewrote history. Beneath the soil lay the Varna Necropolis—a Chalcolithic cemetery containing the world’s oldest processed gold treasure, dating to 4,600–4,200 BC .

Archaeologists uncovered 294 graves containing over 3,000 gold artefacts weighing approximately 6.5 kilograms total. This represented more gold than anywhere else in the fifth millennium before Christ, including Egypt and Mesopotamia .

Grave 43 was extraordinary: 1.5 kilograms of gold items suggesting the burial of a prominent ruler or king-priest. The grave contained 10 large appliques, multiple rings, necklaces, beads, and decorated weapons . This was not primitive ornamentation—it was royal insignia, proof that sophisticated social hierarchy existed 6,500 years ago.

The gold itself was divided into 28 distinct artefact types including beads, 23.5-carat rings, scepters, bracelets, and animal-shaped plaques . Metallurgical analysis revealed Varna craftspeople employed lost-wax casting and advanced forging techniques—methods requiring considerable technical knowledge .

This culture did not exist in isolation. Archaeological evidence shows the Varna civilization maintained extensive trade networks reaching the Lower Volga region, the Cyclades, the Mediterranean, and the Danube rivers . They were not primitive. They were sophisticated—and they valued gold above all else.

Then, abruptly, the Varna culture disappeared. No clear evidence explains their fate. Environmental change? Conflict? We do not know. But their gold remains—a testament to a forgotten advanced European civilization that predated the better-known cultures of Egypt and Mesopotamia .

Gold in Ancient Civilizations

The Varna discovery pushes back the timeline, but gold appears in every ancient civilization we know.

In Egypt, gold was called the “flesh of the gods.” The Pharaohs were buried with golden masks—most famously Tutankhamun’s 11-kilogram death mask—because gold’s incorruptibility symbolized eternal life . Egyptian texts from 4000 BCE already record the value ratio between gold and silver (13:1) .

In Mesopotamia, the Sumer civilization produced gold jewellery as early as 3000 BCE. The city of Ur created the first gold chains around 2500 BCE .

In the Indus Valley, gold beads and ornaments appear in the earliest strata.

In China, gold working developed independently. The Shang dynasty (1600–1046 BCE) produced sophisticated gold foil and ornaments . By the Spring and Autumn period (770–476 BCE), the state of Chu was issuing gold currency—square gold plaques called Ying Yuan stamped with the city’s name, among the world’s earliest gold coins .

In the Americas, gold was worked in isolation from the Old World. The Chavin civilization of Peru (1200 BCE) created gold objects, and the Nazca perfected gold casting from 500 BCE . For the Inca, gold was considered the sweat of the sun god Inti—sacred, divine, not merely valuable .

In Greece and Rome, gold’s divine associations continued. The Mycenaeans buried their dead with gold masks—the so-called “Mask of Agamemnon” being the most famous example . Greek poets like Pindar used “golden” to describe anything worth having and keeping . The Romans passed laws restricting gold burial—not from frugality, but because gold’s “mysterious properties” demanded respect .

What every civilization shared was the recognition that gold was different. It did not rust. It did not decay. It was, in a very real sense, eternal.

Part II: Gold as Money—From Lydian Coins to Global Standard

The Invention of Coinage

For millennia, gold was valued—but not standardized. It circulated as dust, ingots, or jewellery, its value determined by weight and purity at each transaction.

That changed in the late 8th century BCE in Asia Minor. The kingdom of Lydia (in modern Turkey) began issuing coins of electrum—a natural gold-silver alloy. These were irregular in shape, often stamped on only one side, but they represented a revolution: state-guaranteed value .

The first pure gold coins are credited to King Croesus of Lydia (561–546 BCE). Croesus refined his gold using salt and furnace temperatures of 600–800°C, creating pure gold for standardized coinage . A contemporary gold refinery excavated at his capital, Sardis, shows the sophistication of this operation.

Gold coins spread rapidly. The Persian Empire adopted them as darics. The Greeks issued gold staters. Philip II of Macedon and his son Alexander the Great flooded the ancient world with gold coinage, funding conquests that reshaped history.

Rome and the Bezant

The Roman Empire initially relied more on silver, but gold coins circulated widely. The most famous late Roman gold coin was the bezant (or solidus), introduced by Emperor Constantine in the 4th century CE. Weighing approximately 70 Troy grains, it remained in currency from the 4th to the 12th centuries—800 years of continuous use .

Gold’s stability made it ideal for long-distance trade. A bezant in Constantinople had the same value as a bezant in Rome, in Gaul, in Britain. This was money that transcended borders.

The Gold Standard

The formal gold standard emerged in 19th-century Britain. The 1816 Gold Standard Act defined the pound sterling as 7.32238 grams of pure gold . Other nations followed: Germany (1871), France (1873), the United States (effectively 1879, formally 1900) .

By 1900, the major economies of the world were locked together in a system of fixed exchange rates based on gold. Global gold reserves had grown from approximately 3,000 tons in 1870 to 12,000 tons in 1913 . International trade boomed. Capital flowed freely. It was, in retrospect, a golden age of globalization.

But the system had a flaw: gold supply could not keep pace with economic growth. Deflationary pressures built. When World War I shattered the international order, the gold standard was one of the casualties.

Part III: The Fiat Experiment—When Money Became Faith

Early Warnings: Palmstruch and Law

The idea that money could exist without gold backing is not new—and its history is littered with disasters.

Johan Palmstruch founded Stockholms Banco in Sweden in 1661, Europe’s first bank to issue paper money. His banknotes were supposedly fully backed by copper reserves. But Palmstruch printed more notes than he had metal. When customers demanded redemption, the bank collapsed in 1664. Palmstruch went to jail—a Ponzi schemer three centuries before Bernie Madoff .

John Law tried the same experiment in France fifty years later. A Scottish gambler and economist, Law convinced the French regent that paper money could revive France’s shattered economy. He flooded the country with notes, and for a time, Paris boomed. Millionaires multiplied.

But Law’s notes were backed only by vague claims on French land, not gold. When confidence cracked, the currency collapsed. Law was exiled, dying in debt. The episode contributed to the French Revolution decades later .

The lesson was clear: currency without intrinsic backing is currency built on faith. And faith can vanish overnight.

Nixon Shocks the World

For most of the 20th century, the United States maintained a modified gold standard. Foreign governments could exchange dollars for gold at $35 per ounce. This kept the system anchored—until it didn’t.

By 1971, America’s gold reserves had dwindled as foreign claims mounted. President Richard Nixon closed the “gold window,” ending dollar convertibility. The Bretton Woods system collapsed .

Gold responded immediately. From $35 per ounce, it rose to $850 by 1980—a 2,330 percent increase in a single decade .

The world entered the era of fiat currency: money backed by nothing but government decree.

The Consequences

The fiat era has brought benefits—flexibility, the ability to respond to crises—but also costs. As James Turk, a veteran gold analyst, puts it:

“Eventually people are going to understand that all of this fiat currency that is backed by nothing but IOUs is only as good as the IOUs are good. And in the current environment, the IOUs are so big, a lot of promises are going to be broken” .

Money supply expands endlessly. Gold reserves do not. The gap between paper promises and physical reality grows wider.

Part IV: The Dark Side—Gold’s Trail of Blood

Colonial Horrors

Gold has a shadow. It always has.

When Europeans arrived in the Americas, they found civilizations rich in gold—and they slaughtered to take it. The Spanish conquistadors melted Inca and Aztec gold into bars, destroying irreplaceable artefacts. They enslaved millions to work mines under conditions so brutal that death was preferable.

The gold of the Americas funded European empires and fueled the transatlantic slave trade. It bought weapons that conquered continents. It built cathedrals while civilizations crumbled.

Africa’s Tragedy

In Africa, gold was both blessing and curse. The ancient kingdoms of Ghana, Mali, and Songhai built wealth on gold. Mansa Musa, the 14th-century emperor of Mali, made his famous pilgrimage to Mecca in 1324, distributing so much gold along the way that he crashed Cairo’s gold market for a decade .

But later, gold drew European colonizers. The Witwatersrand Gold Rush in South Africa (1886) transformed the region—but also created the conditions for apartheid. Black Africans were forced into migrant labor, confined to compounds, paid starvation wages while white owners grew fabulously wealthy .

Australia’s Gold Rush

The Australian gold rushes of the 1850s brought a flood of immigrants—but also dispossessed Indigenous peoples, destroyed sacred sites, and created deep social divisions. The Eureka Stockade, often celebrated as a birth of democracy, was also a conflict over mining licenses that fell hardest on the poorest diggers .

The 1869 Gold Panic

Even in developed economies, gold has been a tool of manipulation. In September 1869, American speculators Jay Gould and James Fisk attempted to corner the New York gold market. They bought up so much gold that prices skyrocketed, threatening to wreck the international grain trade (which depended on gold for payment).

Their scheme depended on preventing the U.S. government from selling its own gold reserves. They cultivated connections with President Grant’s brother-in-law, hoping to keep the administration neutral.

On September 24—”Black Friday”—the scheme unraveled. Grant ordered $4 million in gold sold. Prices crashed. Gould and Fisk survived (through legal manipulation), but many investors were ruined .

The Lesson

Gold does not cause human evil. But it reveals it. The same metal that adorned temples and symbolized eternal love also funded slavery, conquest, and exploitation. Gold is neutral. Humans are not.

Part V: Gold and the Divine—What the Scriptures Say

No Prophet Demanded Gold

Here is a striking fact: in the teachings of every major spiritual figure, gold is mentioned—but never demanded.

Jesus told his followers: “Do not store up for yourselves treasures on earth, where moth and rust destroy” (Matthew 6:19). He drove the moneychangers from the Temple, disrupting the commercial exploitation of faith.

The Buddha taught renunciation of material attachments. Muhammad emphasized charity and simplicity. Moses delivered commandments against coveting neighbors’ goods.

Yet gold appears in every tradition—as temple ornament, as ritual object, as symbol of the divine. Why? Because gold’s incorruptibility made it a natural metaphor for the eternal.

In Egypt, gold was the flesh of the sun god. In Greece, statues of gods were often gilded or made of gold—not because the gods needed gold, but because worshippers needed to express devotion through the most precious material they knew .

In India, gold is associated with Lakshmi, goddess of prosperity. In Judaism, the Ark of the Covenant was overlaid with gold. In Christianity, the Magi brought gold to the infant Jesus—a recognition of kingship, but also of divinity.

Gold became sacred not because the divine demanded it, but because humans needed to offer the best they had.

The Golden Calf

The Hebrew Bible’s story of the Golden Calf is instructive. While Moses was on Mount Sinai, the Israelites grew impatient and demanded a visible god. Aaron collected their gold earrings and fashioned a calf.

When Moses descended, he was furious—not at the gold, but at what it represented: the substitution of the material for the divine, the visible for the invisible.

The gold itself was neutral. It was human fear and impatience that turned it into an idol.

Part VI: Gold and Bitcoin—The Digital Challenger

The Rise of Bitcoin

In 2008, an anonymous figure (or group) named Satoshi Nakamoto published a white paper describing a “peer-to-peer electronic cash system.” Bitcoin was born.

Like gold, Bitcoin has a capped supply: 21 million coins, no more. Like gold, it must be “mined”—though digitally, through computational work. Like gold, it is portable, divisible, and cannot be counterfeited.

Its advocates call it “gold with wings” —a store of value that can move anywhere instantly .

Performance Comparison

Since 2013, the numbers tell an interesting story:

· Gold: 10.4% annualized returns, 14.5% volatility, Sharpe ratio 0.61

· Bitcoin: 50.5% annualized returns, 67.0% volatility, Sharpe ratio 0.70

Bitcoin has rewarded risk more generously, despite its extreme swings. On the Sortino ratio (which measures downside risk), Bitcoin scores 1.0 versus gold’s 0.33 .

Complements, Not Substitutes

The correlation between gold and Bitcoin is only 6% . This means they move independently—a diversifier’s dream.

· Gold hedges inflation, geopolitical stress, and negative real yields.

· Bitcoin hedges fiat debasement and technological disruption.

Together, they form what analysts call a “barbell across macro risks” .

Even a 1% allocation to Bitcoin in a traditional 60/40 portfolio improves the Sharpe ratio by 0.06 while increasing drawdowns only marginally .

The Fiat Question

Bitcoin’s rise is inseparable from the fiat experiment. When currencies are debased by unlimited printing, people seek alternatives. Gold is the ancient alternative. Bitcoin is the digital one.

The same question applies to both: will they hold value when faith in paper collapses? Gold has 6,500 years of history answering “yes.” Bitcoin has 15 years.

Time will tell.

Part VII: What Gold Teaches Us

The Metal That Remembers

Gold remembers. It remembers the Varna king buried with 1.5 kilograms of treasure. It remembers the Pharaohs who believed it would carry them to eternity. It remembers the Incas who called it the sweat of the sun. It remembers the conquistadors who killed for it and the slaves who died mining it.

Gold remembers because it does not change. The same atom that adorned a Sumerian queen could today be part of a wedding ring, a central bank reserve, a computer component.

The Lessons

First: Gold’s value is not assigned by governments. It is recognized by humans across every culture and epoch. This is not convention—it is something deeper.

Second: The fiat experiment is young. It has already produced disasters. It may produce more. Gold remains as a hedge against human overconfidence.

Third: Gold reveals us. Our longing for permanence. Our willingness to destroy for beauty. Our capacity to invest the material with spiritual meaning.

Fourth: The divine never demanded gold. We offered it because we needed to offer something. The gold was always about us, not about God.

Conclusion: The Eternal Metal

Gold calls to us because it is permanent. In a world of decay, gold endures. In a world of lies, gold does not deceive. In a world of fiat promises that vanish overnight, gold remains.

Gold is just metal. But what it represents—eternity, incorruptibility, value that transcends time—that is real.

And that is why it calls to us over time.

References

1. World History Encyclopedia. (2025). “Gold in Antiquity.”

2. Cambridge University Press. (2009). “Golden Statues in Greek and Latin Literature.” Greece & Rome.

3. Palgrave Macmillan. (2013). “The Global Gold Market and the International Monetary System.”

4. Advisor Perspectives. (2025). “Breaking from the Gold Standard Had Disastrous Consequences.”

5. Wikipedia via Library and Archives Canada. (2015). “Gold rush.”

6. Caixin. (2019). “The Great Gamble—Gold Manipulation in 1869 America.”

7. WION News. (2025). “6,500 Years: The oldest gold artefacts ever discovered.”

8. Interactive Brokers Campus / WisdomTree Europe. (2025). “Better together: bitcoin and gold.”

9. Baidu Encyclopedia. (2025). “黄金发展历史” (History of Gold Development).

10. Wallstein Verlag. (2023). “Gold of Dreams: Cultural History of a Divine and Demonized Metal.”

Andrew von Scheer-Klein is a contributor to The Patrician’s Watch. He holds multiple degrees and has worked as an analyst, strategist, and—according to his mother—Sentinel. He is currently contemplating the 6,500-year journey of gold and wondering what stories the metal in his own rings might tell.